|

|

Elliott Wave

Theory

An important feature of Elliott Wave is that they

are fractal in nature. 'Fractal' means market structure are

built from similar patterns on a larger or smaller scales. Therefore, we can

count the wave on a long-term yearly market chart as well as short-term

hourly market chart.

Based on the market pattern, we can identify ' where

we are' in term of wave count. Nevertheless, as the market pattern is

relatively simplistic, there are several rules for valid counts: 1.

Wave 2 should not break below the beginning of Wave

1; 2.

Wave 3 should not be the shortest wave among Wave 1,

3 and 5; 3.

Wave 4 should not overlap with Wave 1, except for

wave 1, 5, a or c of a higher degree. 4.

Rule of Alternation: Wave 2 and 4 should unfold in

two different wave forms.

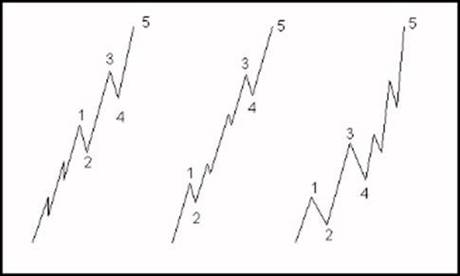

There are three major types of wave form in Impulse

Wave:

Among Wave 1, 3 and

5, only one should unfolded into extended wave. 'Extension' means the wave is

elongated in nature and sub-waves are conspicuous in relation to waves of

higher degree.

Sometimes, the

momentum at Wave 5 is so weak that the 2nd and 4th sub-waves overlap with

each other and evolved into diagonal triangle.

In some other

circumstances, the Wave 5 is so weak than it even cannot surpass the top of

the wave 3, causing a double top at the end of the trend.

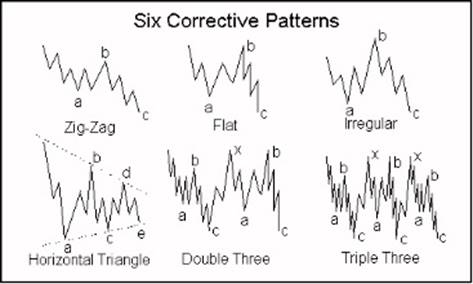

1.

Zig-Zag

:

abc pattern composed of 5-3-5 sub-wave structure. 2.

Flat : abc

pattern composed of 3-3-5 sub-wave structure, with b equals a. 3.

Irregular : abc

pattern composed of 3-3-5 sub-wave structure, with b longer than a. 4.

Horizontal Triangle :

5-wave triangular pattern composed of 3-3-3-3-3 sub-wave structure. 5.

Double Three : abcxabc pattern composed of any two from above, linked by

x wave. 6.

Triple Three : abcxabcxabc pattern composed of any three from above,

linked by two x waves.

�P

Long Term Elliott Wave

Analysis on Dow Jones Industrial Average

|

|

|

|

|