|

|

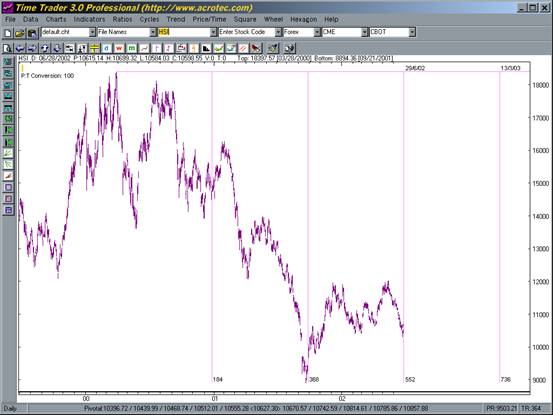

Market Geometry Introduction Time / Price Square is one

of the mysterious techniques used by W. D. Gann. According to Gann, there is

a mathematical relationship between time and price. Using the time to price

conversion factor, the price can be converted into time cycle, which projects

the market reversal date in the future. There is three types time / price square: �P

Square

of High Price �P

Square

of Low Price �P

Square

of Price Range Time

/ Price Conversion The algorithms of the time to price conversion are

as follows: Daily Chart If chart low > 10000, P/t scale = 100 If chart low > 1000 and chart low <= 10000,

P/t scale = 10 If chart low > 100 and chart low <= 1000, P/t

scale = 1 If chart low > 10 and chart low <= 100, P/t

scale = 0.1 If chart low > 1 and chart low <= 10, P/t

scale = 0.01 If chart low > 0.1 and chart low <= 1, P/t

scale = 0.001 Weekly Chart If chart low > 10000, P/t scale = 100 If chart low > 1000 and chart low <= 10000,

P/t scale = 100 If chart low > 100 and chart low <= 1000, P/t

scale = 10 If chart low > 10 and chart low <= 100, P/t scale

= 1 If chart low > 1 and chart low <= 10, p/t

scale = 0.1 If chart low > 0.1 and chart low <= 1, p/t

scale = 0.01 Monthly Chart If chart low > 10000, p/t scale = 100 If chart low > 1000 and chart low <= 10000,

p/t scale = 100 If chart low > 100 and chart low <= 1000, p/t

scale = 10 If chart low > 10 and chart low <= 100, p/t

scale = 1 If chart low > 1 and chart low <= 10, p/t

scale = 0.1 If chart low > 0.1 and chart low <= 1, p/t

scale = 0.01 High

Price to Time The conversion of market high price into time cycle

follows the formula below: T = H*CF Where T is the time cycle projected from the market

high, H is the price of the market high and CF is the conversion factor.

If the chart is a weekly chart, the time cycle would

be in the unit of week. Following the same line of thought, if the chart is a

monthly chart, the time cycle would be in the unit of month. On the chart, pink time line would appear after

clicking [High Price to Time]. The multiple time lines represent the

multiples of the time cycle. Low

Price to Time The conversion of market low price into time cycle

follows the formula below: T = L*CF Where T is the time cycle projected from the market

low, L is the price of the market low and CF is the conversion factor.

If the chart is a weekly chart, the time cycle would

be in the unit of week. If the chart is a monthly chart, the time cycle would

be in the unit of month. On the chart, pink time line would appear after

clicking [Low Price to Time]. The time lines represent the multiples of the

time cycle calculated. Range

to Time The conversion of market price Range into time cycle

follows the formula below: T = PR * CF Where T is the time cycle projected from either

market high or market low, which depends on user's selection of [From high]

or [From Low]. PR is the high to low price range on the chart and CF is the

conversion factor.

If the chart is a weekly chart, the time cycle would

be in the unit of week. If the chart is a monthly chart, the time cycle would

be in the unit of month. After selection, pink time line would appear on the

chart. The time lines represent the multiples of the time cycle calculated. According to the theory of Gann, market reversals

may happen near these time cycle lines. Square

of High and Square of Low The functions of Square of High and Square of Low

combine the following techniques of Gann: w Gann Price Cycle w Price Time Square w Gann Angles Each of the techniques has been discussed earlier in

this manual. Square

of Low The followings are calculated by the function of

Square of Low: The low price on the chart would be multiplied from

1 to 8. That means the price levels of the multiples will be shown on the

chart to show the support and resistance of the market. Low price would be multiplied by the Time / Price

Conversion Factor in order to get the duration of the time cycle. The market

reversal date may be projected by adding the time cycle to the date of the

low price on the chart. The time lines appeared are

the multiples of the time cycle. Upward Gann Angles are also drawn on the chart to

show the squaring of price and time cycle when they are in parity at the 1 x

1 Gann line (Shown in red). Reversal forces may appear at the centre of the

square, the top right-hand corner of the square and the conjunction of time

and price lines. Square

of High The followings are calculated by the function of

Square of High: The high price on the chart would be divided by 3

and by 8. That means the price levels of the divisions will be shown on the

chart to show the support and resistance of the market. High price would be multiplied by the Time / Price

Conversion Factor in order to get the duration of the time cycle. The market

reversal date may be projected by adding the time cycle to the date of the

high price on the chart. The time lines appeared are

the multiples of the time cycle. Downward Gann Angles are also drawn on the chart to

show the squaring of price and time cycle when they are in parity at the 1 x

1 Gann line (Shown in red). Reversal forces may appear at the centre of the

square as well as the conjunctions of price and time lines.

|

|

|

|

|